Roth ira contribution limit calculator

Low contribution limitThe annual IRA contribution limit for the 2022 tax year is 6000 for those under the age of 50 or 7000 for those 50 and older. Catch-up 50 Year Old.

What Is The Best Roth Ira Calculator District Capital Management

Heres how a Roth IRA works who qualifies and FAQs.

. There is no upper age limit to make a contribution to a Roth IRA either before or after 2020. Its an important number to know for penalty-free withdrawals. 1 2020 there is no maximum age at which you can make a contribution as long as you have sufficient taxable compensation to support the contribution amount.

This means that a single young taxpayer could split up to the limit for each year between their Roth IRA and traditional IRA. Roth IRA income limits are 140000 for singles or 208000 for joint filers. Decide how you want to invest.

Internal Revenue Service. What Is a Roth IRA Phaseout Limit. Roth IRAs are subject to the same rules as traditional IRAs.

If youre single you cant contribute to a Roth IRA if you earn more than 144000 in 2022. In comparison the 401k. If you are an eligible individual who is age 55 or older at the end of your tax year your contribution limit is increased by 1000.

Roth IRA contribution limits are 6000 in 2021 plus 1000 if 50. Lets say you open a Roth IRA and contribute the maximum amount each year. Assuming you are allowed to make the maximum contribution and earn more than 60000 per year.

2000 contribution Year 9. If youre married and file taxes jointly that income limit for Roth IRA contributions is 214000 for 2022. A Roth IRA phaseout is the income level at which your contribution to these after-tax retirement savings accounts can be reduced or phased out completely.

These limits apply to all IRA accounts for an individual taxpayer. You could be subject to an extra 6 tax. Historical Sources on the IRA Limit.

A Roth IRA is a retirement account in which after-tax money grows tax-free and withdrawals are tax-free. Visit the Roth IRA Conversion Calculator to model whether it is worth making a conversion. For a traditional IRA as of Jan.

Amount of Roth IRA Contributions That You Can Make For 2021 Internal Revenue Service. The big one is the contribution limit. 2022 IRA Contribution and Deduction Limits Effect of Modified AGI on Deductible Contributions If You Are Covered by a Retirement Plan at Work.

Roth 401k With a Match. Roth IRAs have the same annual contribution limits as traditional IRAs for 2021 and 2022. 129000 but.

Modified adjusted gross income MAGI Contribution Limit. Decide if you want to manage the investments in your IRA or have us do it for you. Plus a Roth IRA has an income limit on contributions 129000 for single filers and 204000 for married couples.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. For example lets say youve previously made 94000 in pre-tax contributions to a traditional IRA and make a non-deductible IRA contribution of 6000 this year with the intention of. 6500 per taxpayer 49 and younger.

The maximum allowable contribution to a Roth IRA in 2022 is just 6000 for those below the age of 50. If the contribution limit remains 6000 per year for those under 50 youd amass 83095 assuming a 7 growth rate after 10 years. 4 A Roth 401k has no income limit.

Your eligibility to open a Roth IRA and how much you can contribute is determined by your Modified Adjusted Gross Income MAGI. Calculate your IRA contribution limit. Standard Contribution Limit.

Roth IRA Contribution Limits for 2021 and 2022. The History of the IRA Contribution Limit and Non-Working Spouse Contribution 1974-2022 Year. This limit applies across all IRAs.

If you are a single or joint filer your maximum contribution starts to reduce at 125000 and 198000 for tax year 2021 and 129000 and 204000 for tax year 2022 respectively. The lower of 6000 or your taxable compensation. You may contribute simultaneously to a Traditional IRA and a Roth IRA subject to eligibility as long as the total contributed to all Traditional andor Roth IRAs totals no more than 6000 7000 for those age 50 and over for tax year 2021 and no more than 6000 7000 for those age 50 and over for tax year 2022.

7500 per taxpayer 50 and older. While a Roth 401k has a 20500 contribution limit a Roth IRAs limit is 6000or 7000 if youre 50 or older. 3000 distribution Year 8.

That said Roth IRA accounts have historically delivered between 7 and 10 average annual returns. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. This allows you to open a traditional IRA or another type of retirement account contribute funds and then convert the account into a Roth IRA.

The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older. The amount you can invest each year is limited based on your filing status. However there are some exceptions.

144000 Partial contribution. Traditional IRA comparison page to see what option might be right for you. Roth IRA contributions are still a long-term investment in a retirement savings plan.

Roth IRA income requirements 2022. Amount of Roth IRA Contributions That You Can Make for 2022 Internal Revenue Service. 129000 but.

For example if you have self-only coverage you can contribute up to 4600 the contribution limit for self-only coverage 3600 plus the additional contribution of. However contributions to a Roth IRA arent tax deductible. You can contribute a total of 6000 to either your traditional or Roth IRA without exceeding the contribution limits if you were 49 years old or younger in 2022.

Keep in mind that the combined annual contribution limit always applies. Still you must have taxable. You must designate the account as a Roth IRA when you start the account.

144000 Partial contribution. A Roth IRA basis is the total amount of money youve contributed to your Roth IRA. You can use our IRA Contribution Calculator or our Roth vs.

Roth Ira Calculators

What Is The Best Roth Ira Calculator District Capital Management

Ira Calculator See What You Ll Have Saved Dqydj

Historical Roth Ira Contribution Limits Since The Beginning

Roth Ira Calculators

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

2019 Ira 401k And Roth Ira Contribution Limits Roth Ira Eligibility Ira Tax Deductions And More Begin To Invest

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

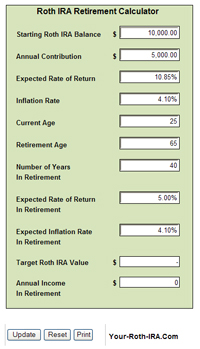

Roth Ira Calculator Roth Ira Contribution

Roth Ira Calculators

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Best Roth Ira Calculators

Download Roth Ira Calculator Excel Template Exceldatapro